Most people plan their retirement backwards, and it can get them into a lot of trouble when they reach retirement age.

When it comes to retirement planning, it’s not about how much you think you need to save, but how much you plan to spend. If that sounds like two sides of the same coin to you, you’re right, because it is.

But which side of that coin you choose to focus on can mean the difference between a comfortable, worry-free retirement, and a retirement where you’re left scrambling to fix a serious mistake when it’s already too late.

The problem is, it’s an easy mistake to make because big numbers have a way of making us feel secure. If you set yourself up with a goal of retiring with, let’s just say for example, a million dollars, it’s hard to imagine how anything could go wrong.

But as you’ll see in the two examples we’re about to explore, that’s exactly what happens when you plan your retirement around a savings goal instead of a spending goal. So let’s break it down.

In both our examples, the couples assume they’ll need a million dollars to retire. They’re each 15 years out from starting their retirement, which is great because it gives them time to adjust their savings goal if they need to. And to keep the comparison clean, they’ll both be receiving the same amount of government benefits in retirement.

Couple number one enjoys the simple pleasures in life and they have a pretty decent handle on their spending habits. For them, $55,000 a year after tax, in today’s dollars, would make for a comfortable retirement, and they figure a million dollars should just about cover that for them.

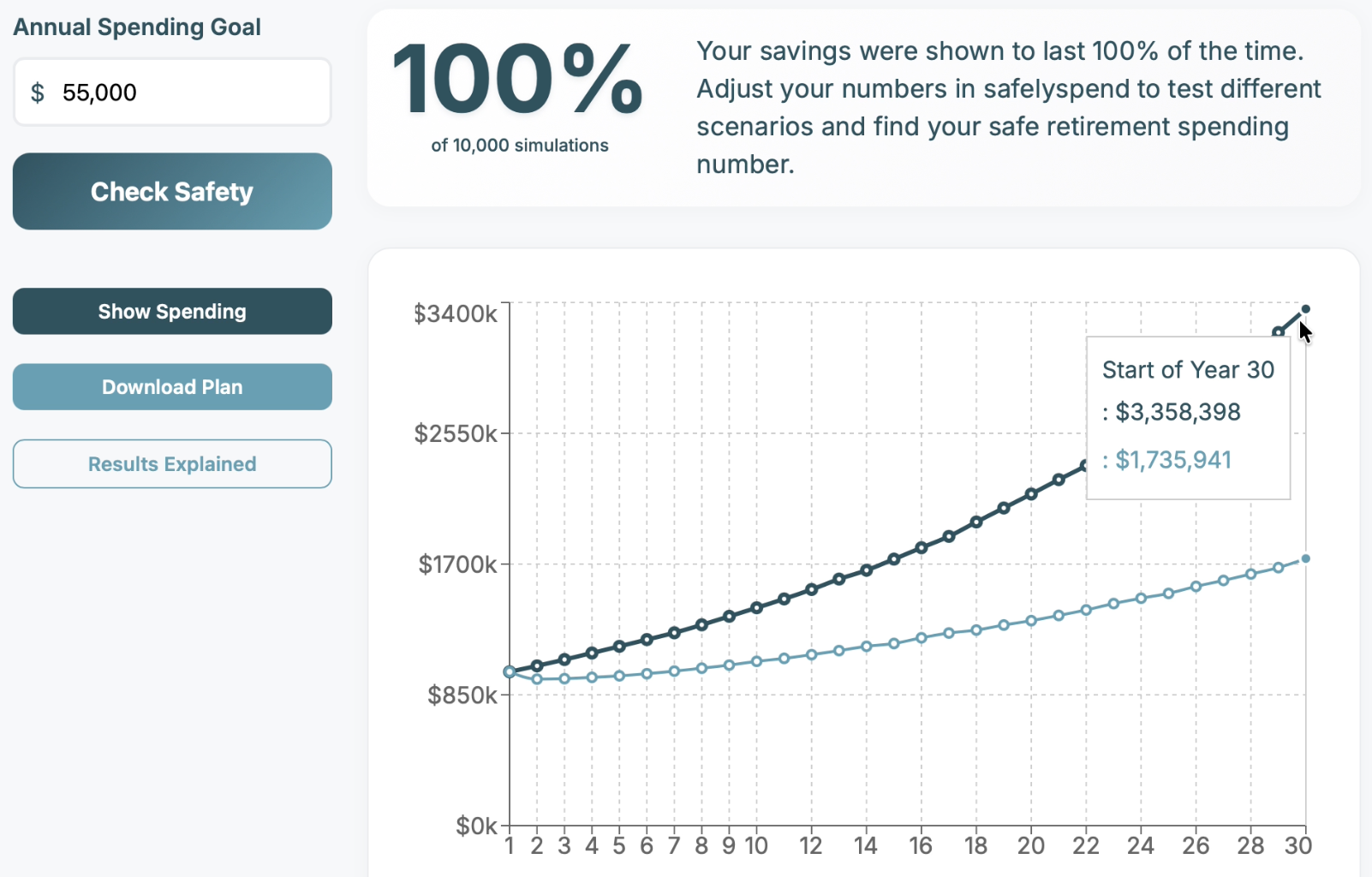

So let’s put those numbers into the SafelySpend app and see what it tells us.

As you can see, they are actually on track to die as millionaires, which tells us they probably didn’t need to have a million dollars saved in the first place.

And keep in mind, this is even after accounting for inflation. Their $55,000 target turns into about $80,000 by the time they start their retirement, and 20 years into retirement it increases to nearly $130k. But even with those ongoing increases, their savings still end up growing substantially in most outcomes.

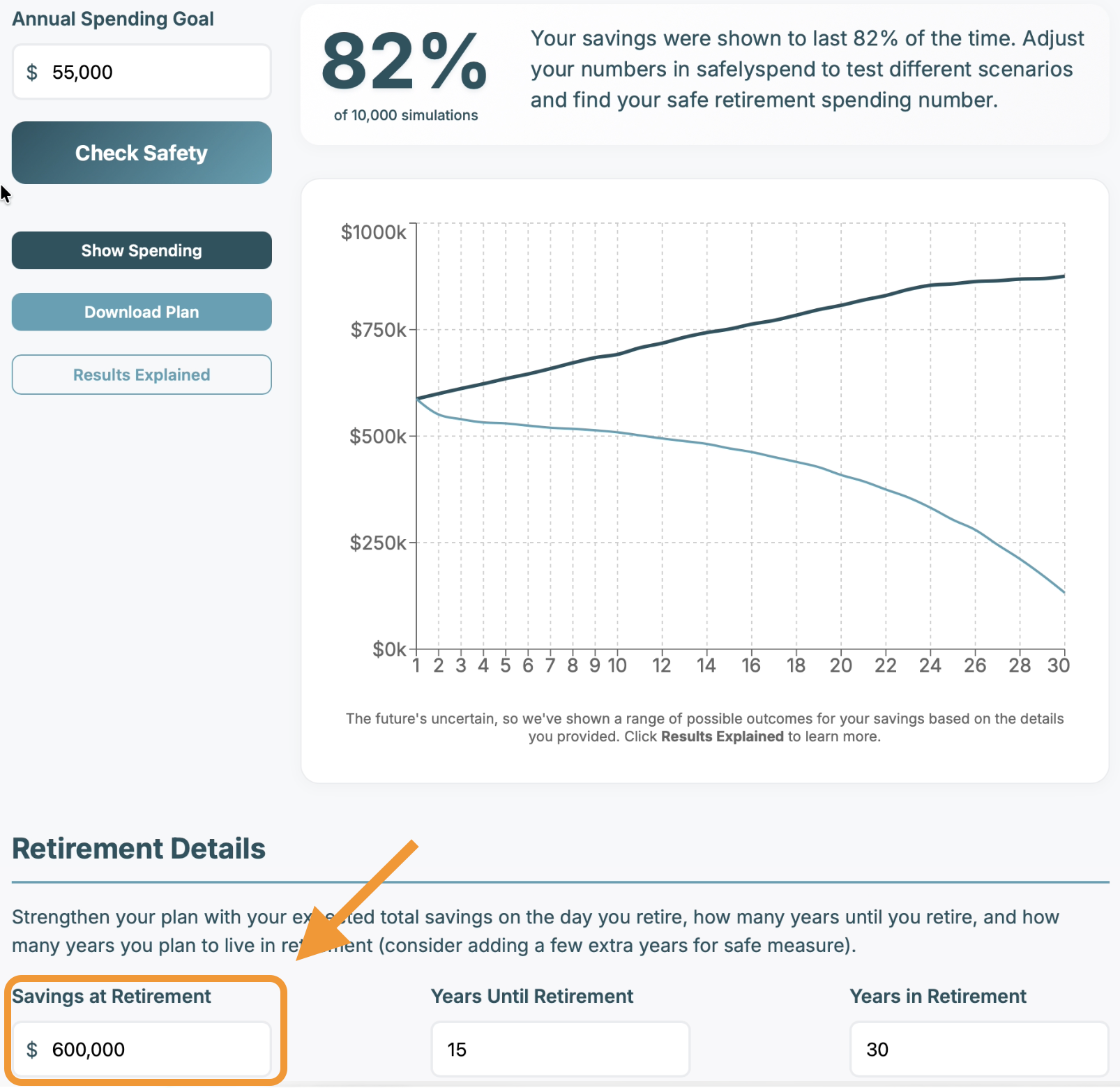

It turns out, they really only need around $600,000 to enjoy the kind of retirement they’re after. That’s a full $400,000 less than they’d been saving for.

What’s great about figuring this out now, with 15 years left to go is they actually have a couple of different options they can explore.

They could stick to their savings goal of a million dollars and just spend more money each year in retirement.

Or they could start saving less, which leaves them with more money to spend now.

Neither of those options really appeal to them since the truth is they just aren’t big spenders.

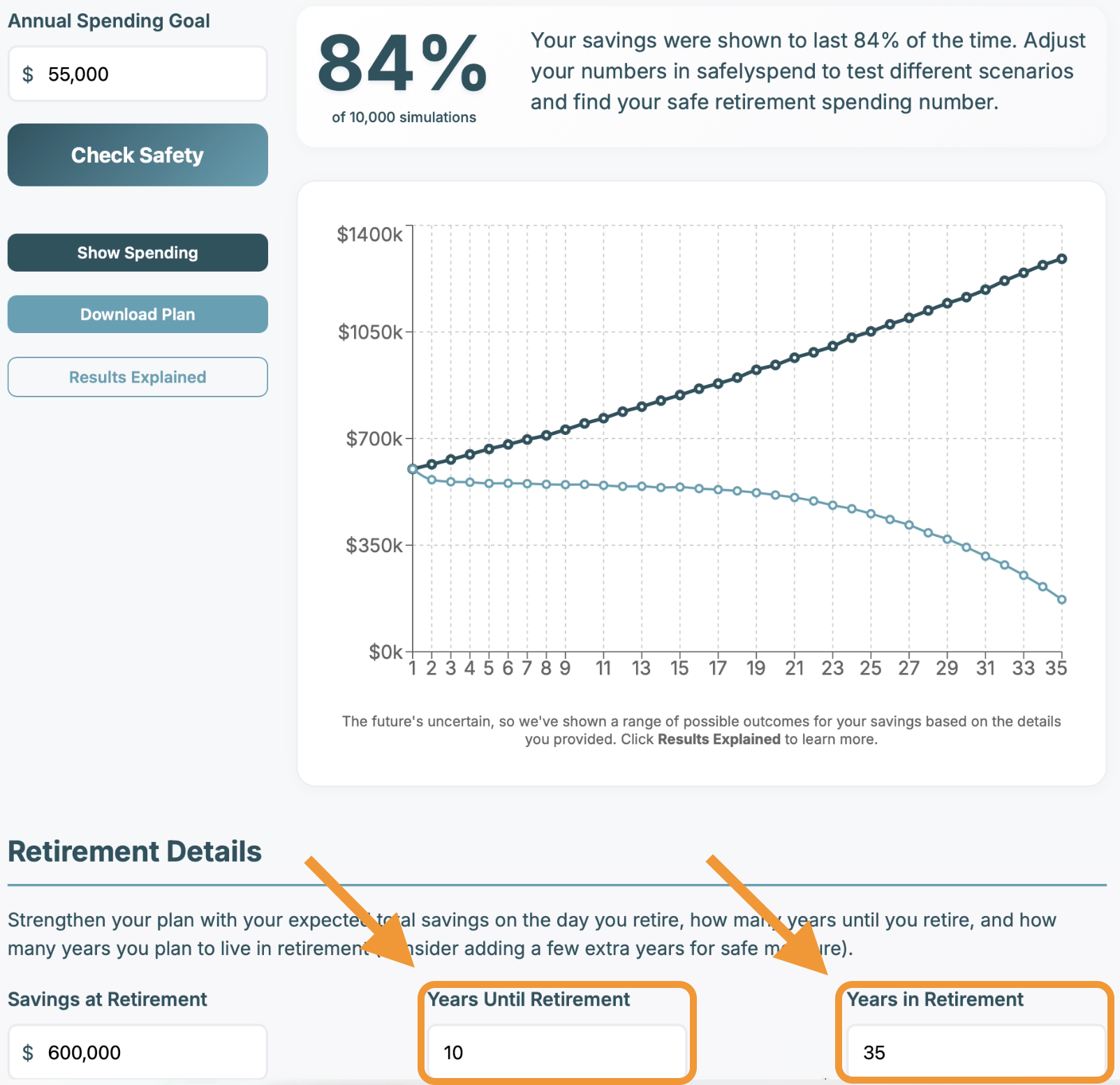

But it turns out there’s a third option they hadn’t considered until now: retiring sooner.

If they stick to their current savings rate, they could actually retire a full five years sooner than planned, which I think most people would agree is a very welcome surprise.

That’s five more years of freedom they get to enjoy now, all because they stopped focusing on an assumed savings goal, and used their spending goal to build a retirement plan that worked best for them.

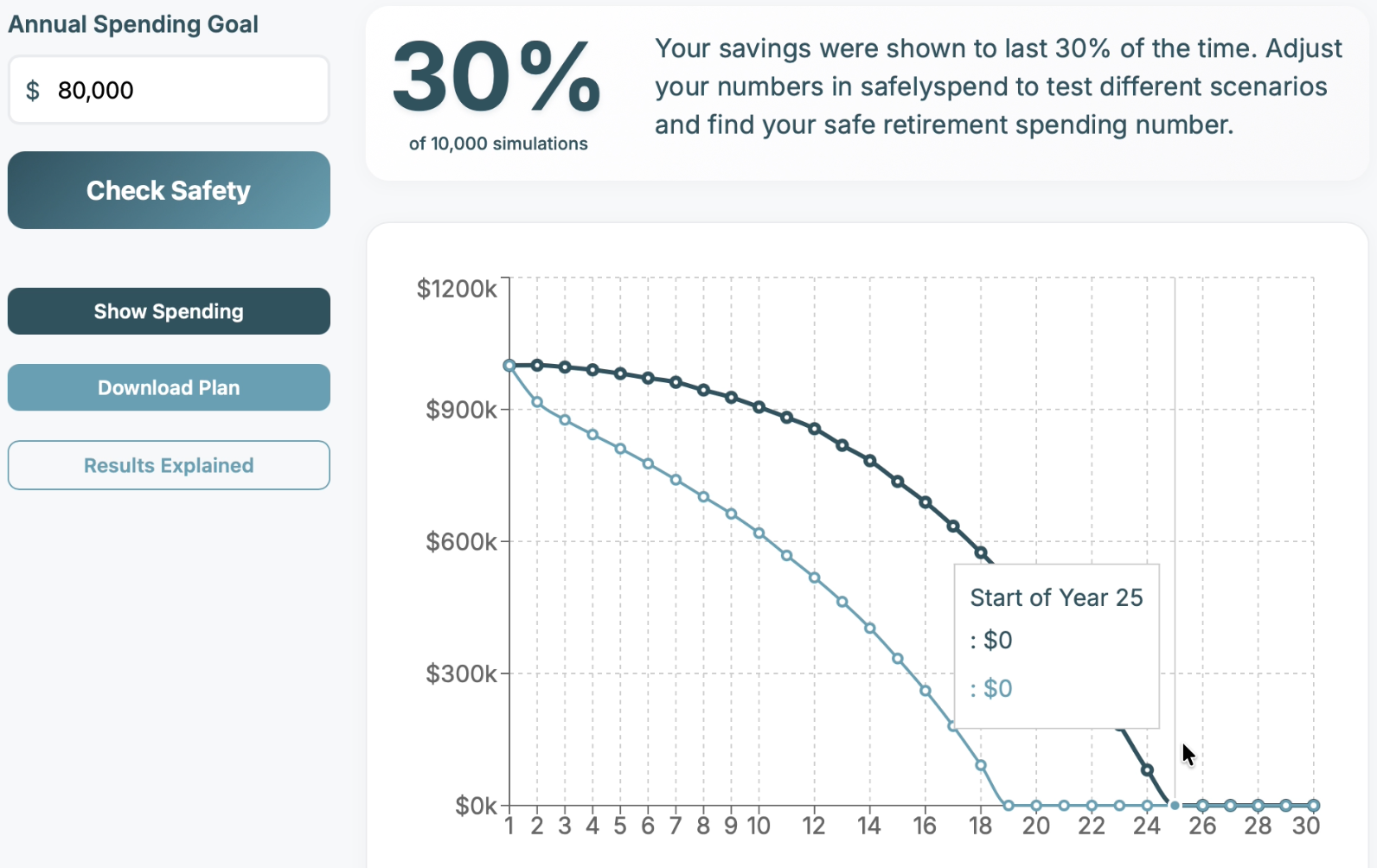

Now let’s take a look at our second couple, who are more inclined to treat themselves from time to time, and don’t really track their spending too closely. In their case, $80,000 a year after tax, in today’s dollars, should give them the kind of retirement they’re looking for.

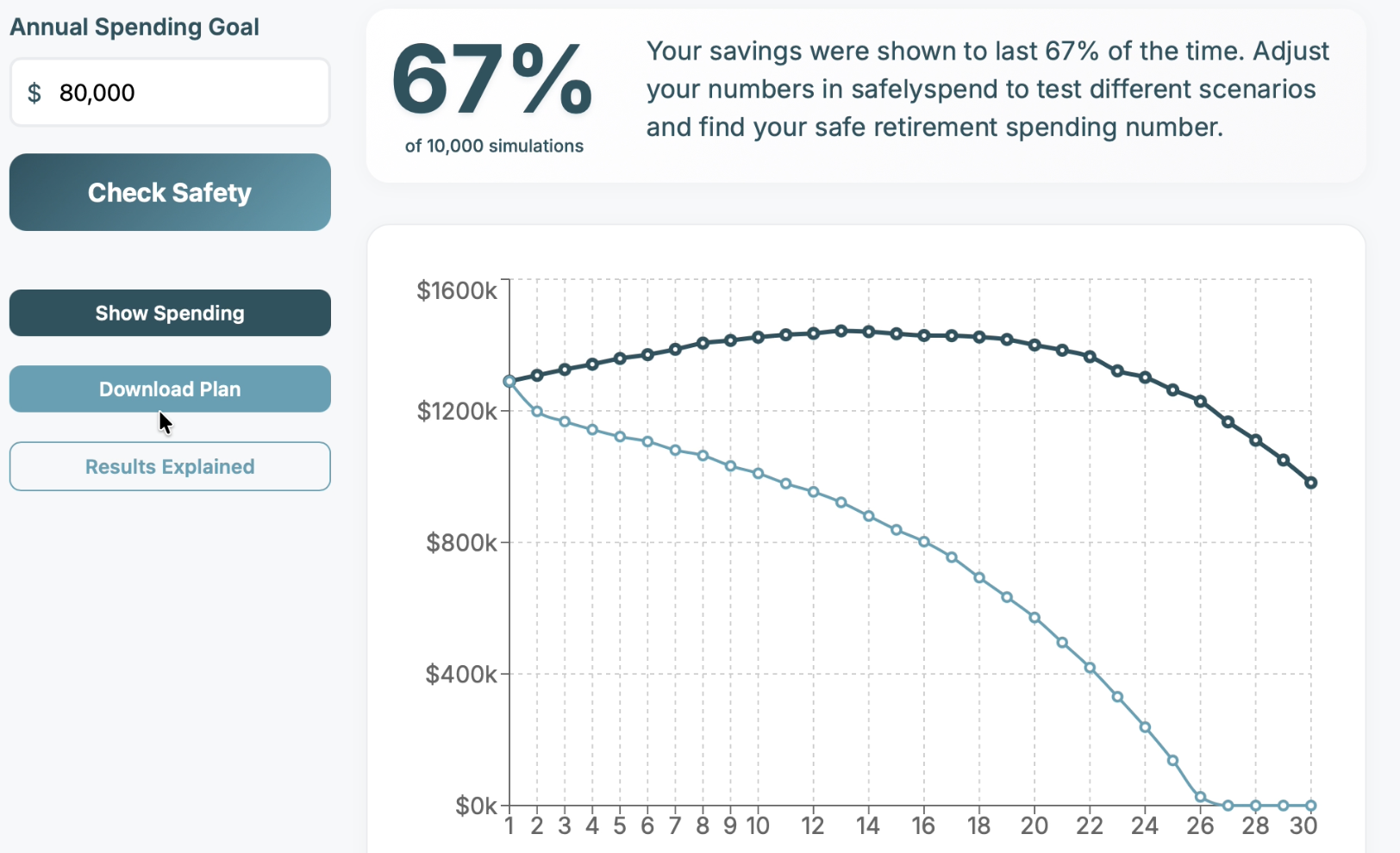

So let’s see how that fares with a million dollars in the mix.

Not good. The odds are heavily favoured for them to run out of their savings way too soon. So clearly a million dollars was not the right idea here and they’ll need to save more.

They don’t love the idea of having to save more because that means cutting into their spending today. But they also really don’t want to spend less in retirement.

After a light budgeting exercise, they determine they can get that million dollar goal up to just shy of $1.3 million, so they plug that into the SafelySpend app and hope for the best.

Now it looks like 67% of the time things work out, but a third of the time there’s still a chance they could run out of their savings too soon. Understandably, they don’t love those odds.

So now they’re left with what appears to be a tough choice. Spend less now, or spend less in retirement.

But just like last time, there’s a third option available now that they hadn’t considered before.

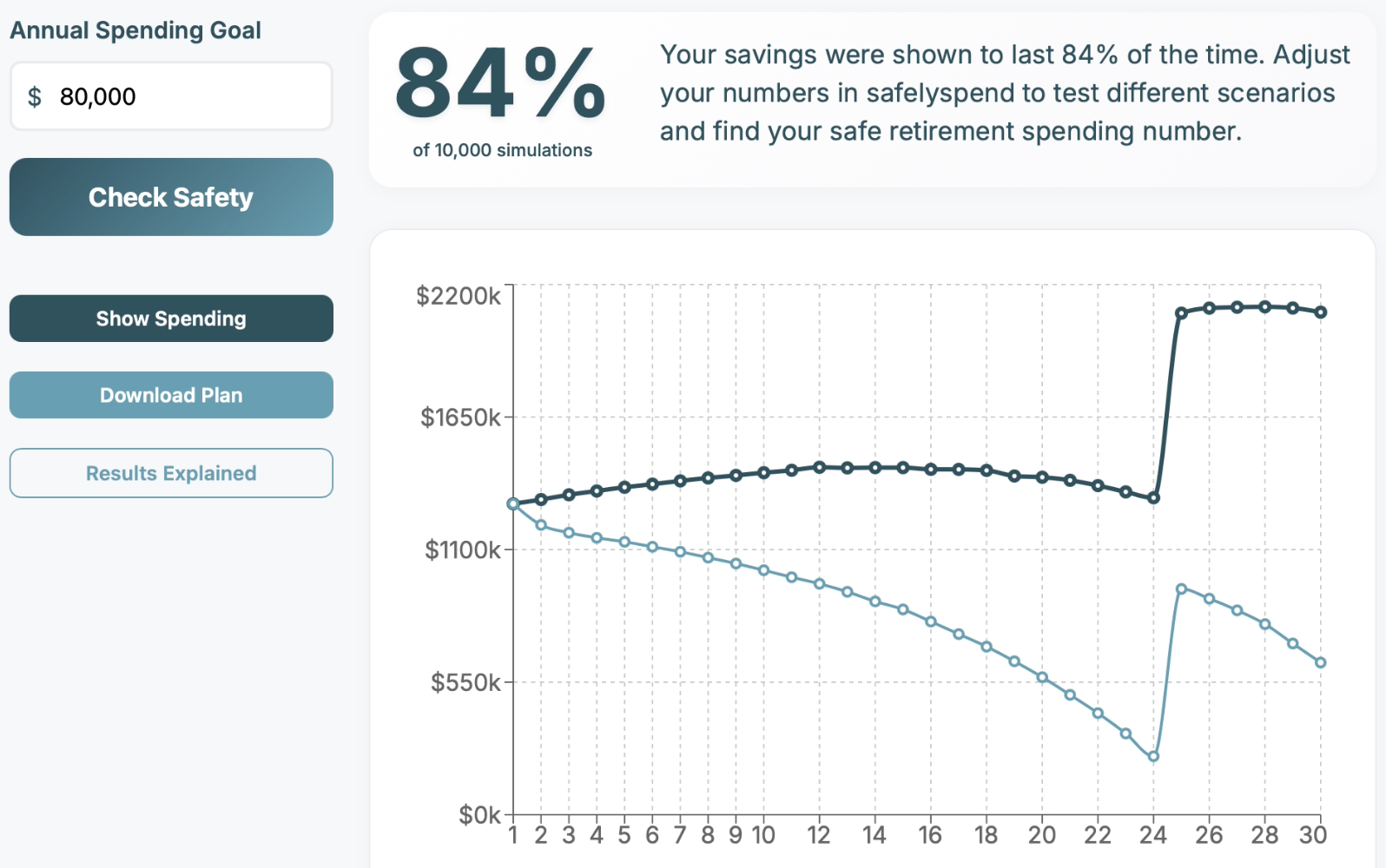

Looking closer at their results, they realize their problem only really shows up in the last five years of their retirement. So they come up with a backup plan: selling their home late in retirement and downsizing to an apartment.

Using their home equity in those last five years gave their odds of success the boost they were looking for. And what’s great about this is they don’t actually have to commit to selling their home. Most scenarios work out just fine without having to take that step. But at least now they know the option is there if they need it.

To recap, we looked at two very different couples who each made the common mistake of focusing on a retirement spending goal that really did seem like the right amount. Thankfully, they tested that against their spending goal when there was still time to adjust and get their retirement plan on the right track.

One couple wound up gaining an extra five years of retirement freedom, while the other managed to stick to their higher spending goal by discovering a backup plan they could have easily missed if they hadn’t run their numbers through the SafelySpend app.

If you want to run your own numbers with SafelySpend and find your safe retirement spending number, you should give SafelySpend a try. Unlike a lot of other retirement planning tools out there, SafelySpend is not a subscription. You get unlimited usage for a one time payment of just $20.

Click here to get started and discover how much you can safely spend in your retirement.