Can you retire with $500k in savings? It's a common question that we're going to get to the bottom of in this article. Keep in mind, everyone's situation is different, but I'll show you an example using SafelySpend that should at least help shed some light on the subject for you.

Probably the biggest concern most people have for their retirement is whether or not they'll run out of money. To avoid that, far too many will end up spending less than they could have, basically sapping all the fun out of being retired in the first place.

Retirement is all about enjoying your personal freedom, so let's take the worry out of the equation with SafelySpend.

For our example scenario, we have a household that is five years away from retirement and wants their savings to last for at least 30 years. They've got some standard issue government benefits coming their way, so their savings will be topping up that income to meet their safe spending goal.

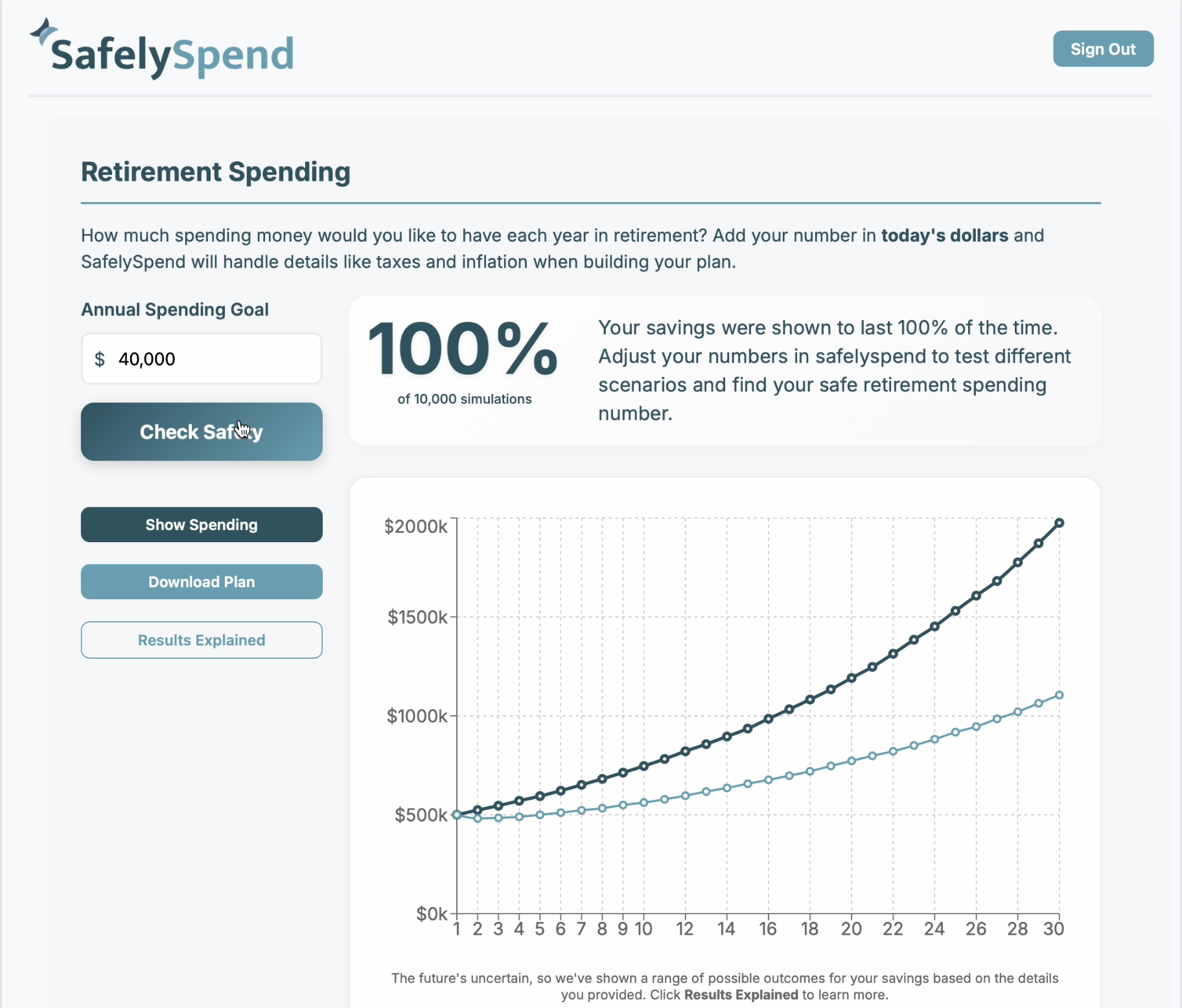

They're a little nervous about overspending, so they're starting off with an assumption of getting by on $40k a year of after tax spending money in today's dollars, which would be adjusted up for inflation each year. So let's put that spending goal into the SafelySpend app and see what it tells us.

As you can see, they came in way under on their spending goal. Out of ten thousand simulations, their savings were shown to outlast them 100% of the time. This is all fine and good if they want to leave something sizable behind, but they worked hard for this money so let's see if we can help them enjoy more of it together.

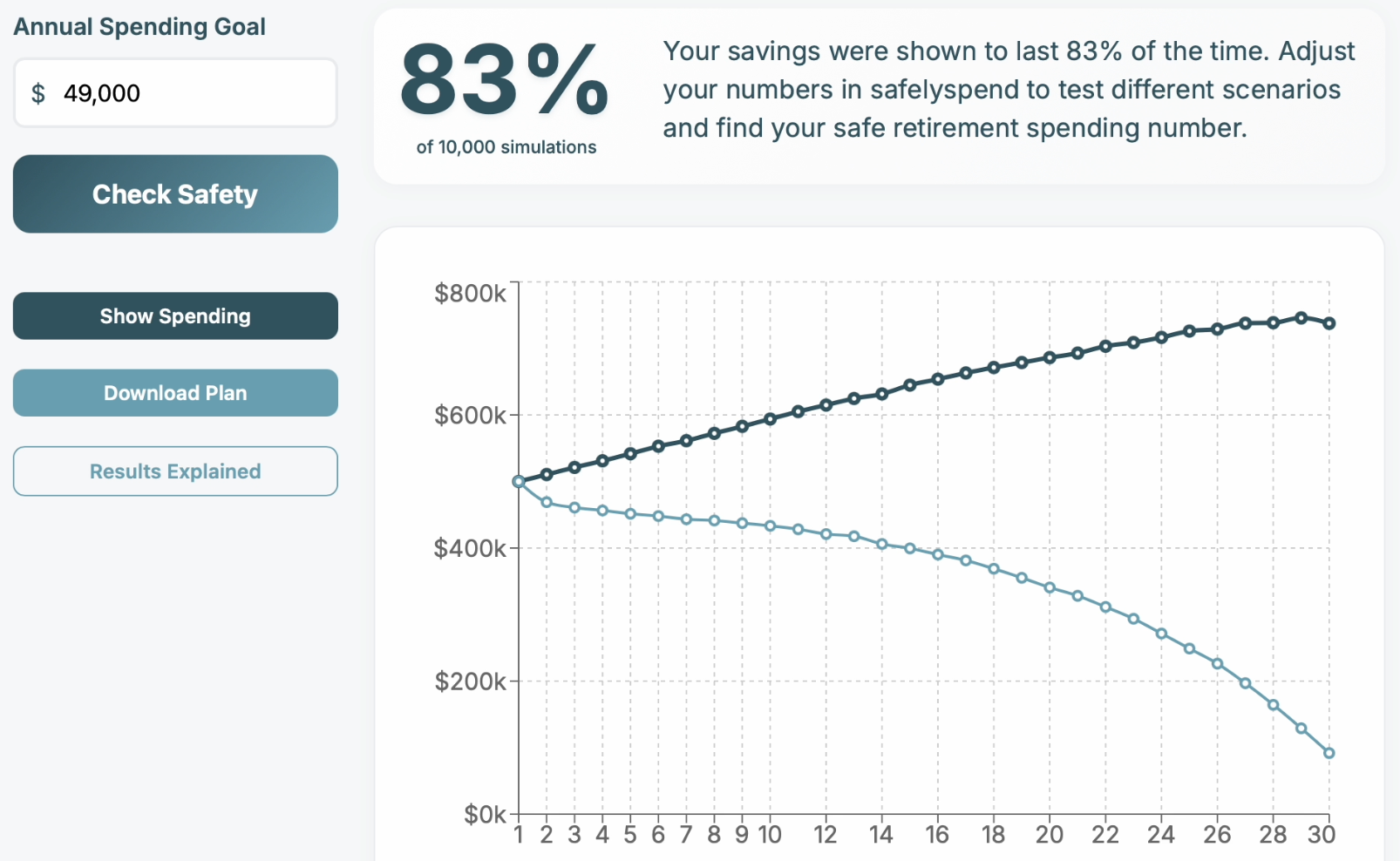

It turns out the sweet spot for their situation is $49k a year. In that scenario, the median result line has no problem making it to the end, and the 20th percentile line, which is a good indicator for whether or not your savings can withstand more tougher than usual times over the course of your retirement, gets there as well.

This is important because, as you can see here, SafelySpend adjusts the actual spending number up each year to account for inflation, which ensures your withdrawals, alongside your government benefits, keep up with inflation over the course of your retirement. A good retirement plan has to take this into consideration when determining how long your savings can last, and SafelySpend does exactly that.

So after just a few short minutes using SafelySpend, our example couple went from worrying about how much they could spend, to adding an extra $9k a year to the fun and fulfillment their retirement can bring. That's like two to four weeks of travel each year that they would have denied themselves if they hadn't run the numbers using SafelySpend.

If you want to run your own numbers with SafelySpend and find your safe retirement spending number, you should give SafelySpend a try. Unlike a lot of other retirement planning tools out there, SafelySpend is not a subscription. You get unlimited usage for a one time payment of just $20. Click here to get started and discover how much you can safely spend in your retirement.